What to do if you lose your wallet. Tips on how to stop losing things.

You have probably lost your wallet once or twice in your life. There are hundreds, if not thousand times when we leave home or office and later realize we forgot our wallet, and what is more disappointing, to realize your wallet is not there with you just when you ordered a cup of your favourite coffee or need to pay the restaurant bill. Let’s suppose the police stopped your car and asked for your driver’s license. How bad is that? Let’s think about the even worse situation – when someone stole your wallet. As we suggested in our previous blog post telling what to do if you lose your keys – don’t panic! Here are the steps we offer to do after your wallet has gone missing. If you follow these steps, it will help to minimize the damage if you lost or someone has stolen your wallet, possibly with your driver’s license, credit cards, and other essential pieces of personal identification inside. Thieves know millions of ways to play around with your debit or credit cards causing damages in just a short amount of time. Calling the bank or financial institution that issued your credit or debit card as soon as you realize you lost your wallet. Call your bank or financial institution and tell them that you think your card has been stolen. Your bank will immediately cancel your debit card and issue you a replacement with a new account number. Your bank will also go over recently listed purchases with your card to determine the last legal purchase you made before losing your debit card and if there are some illegal uses. Taking this action rapidly is the key: If you report your card missing within two business days, you’ll only be responsible for a maximum of $50 of unauthorized purchases. Most banks will not ask you for any charge at all. According to the Fair Credit Billing Act, you are not responsible for any fraudulent purchases on your credit card as long as you report your card stolen before a thief starts using it. If a thief does use your credit card before you report it stolen, you’ll only be responsible for a maximum of $50 of unauthorized buys. Even after you’ve canceled your credit and debit cards, you might still be vulnerable. Thieves can use other cards in your wallet, including your Social Security card, if you carry that, to steal your identity. We recommend leaving your Social Security card at home and secured in a safe place at all. There are companies offering Identity theft protection services at affordable prices, so make sure to find them out. Filing a police report is a vital step to protect your identity. If you are a victim of identity theft—you acknowledge that somebody used your identity to create a fake card account; for instance—you can file a complaint with the Federal Trade Commission and fill out a fraud Affidavit. This affidavit allows you to fill out a single form to report information to creditors and lenders regarding your case of fraud. To qualify for this and to file a complaint with the Federal Trade Commission, you will first need to file a police report that will serve as evidence, which is why filing a police report together with your local enforcement is so important. You would also possibly need a police statement to get a brand-new driver’s license or social insurance card. As we have recommended in the beginning, it would be better to keep your Social Security Card in a safe place, tough if your Social Security card was in your wallet, you need to take care of a few more things. Statistics show that thieves can use your Social Security number in different manipulations and fraudulent actions. They can apply for loans or credit lines in your name using this information. If you did make the mistake of keeping your card in your wallet, you would need to ask for a credit freeze with the three national credit bureaus. This may help prevent a thief from opening new credit under your name unless you personally remove the freeze. This is not a free process unless you can prove you’ve already been the victim of identity theft. If you can’t prove this, you’ll usually have to pay a fee, from $2 to $10. You may also have to pay when you remove the freeze. If your driver’s license was in your wallet, you would have to replace it too. If you don’t, you may face a hefty fine if you’re driving, and an officer stops you. You should visit your local DMV to do this. The requirements for a replacement process vary by state, so make sure to check it on the web site of your local DMV. Most states would ask you to represent proof of your residency, usually in the form of various utility bills or another supporting document with your name on it, or your birth certificate, and your Social Security number. Again, you may be required to pay a small fee in some states, so make sure to carry the evidence document given by the police. This will help you get over this process without paying for any service. Gone the years when people suffer from some simple, yet troubling problems, including losing your wallet! Smart technologies, especially the emerging new category called IoT (Internet of Things) devices solve everyday problems in a smart, hassle-less way, letting you enjoy your life more and spend your precious time doing things like looking for your wallet for hours. You should consider getting a Smart Wallet Tracker device and attach it to your wallet never to lose it again. Vozni Tracker is one of the best-in-class wallet trackers, that would seamlessly solve the problem of losing your wallet and other essential items. Get a Vozni Tracker, insert or attach it to your purse or wallet and connect it to your phone. Due to its small size, thin and sleek design, it will perfectly go with all kinds of wallets-be it a stylish and fancy one or made of elegant premium leather. Once you connect the Vozni Tracker to your phone, you can choose to enable separation alerts both on your phone or the tracker itself. Whenever you walk a few steps further, leaving your wallet behind, your phone will notify that you forgot it nearby. At the same time, the tracker will make a loud sound, in case you can’t find it right at first glance. Discover more features and ways to protect your valuables here.

Call your card issuer bank.

Consider identity theft protection.

File a police report

Replace your Social Security card

Get a new driver’s license.

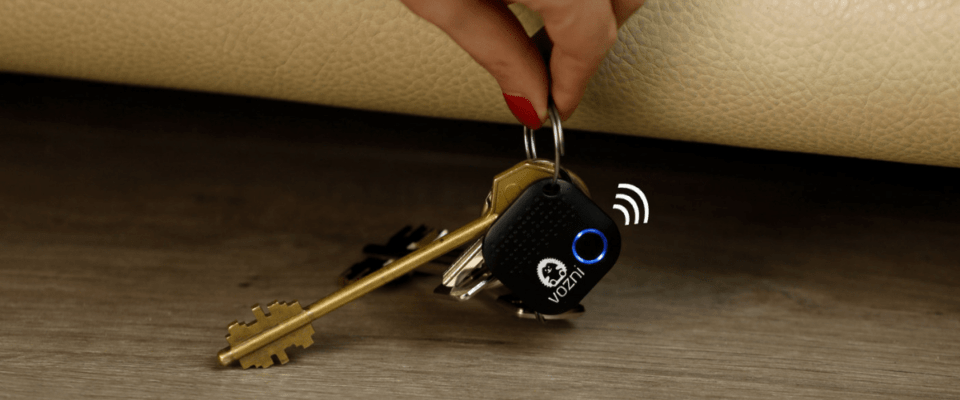

Get a smart wallet tracker.